Construction in progress costs are expensed by debiting the CIP asset account and crediting accounts like cash, accounts payable etc. as costs are incurred. Once construction is complete, the asset is reclassified from CIP to a fixed asset account like buildings, where it begins to be depreciated. Revenue recognition https://www.bookstime.com/articles/statement-of-stockholders-equity is the process of recording and reporting revenue in financial statements. In construction accounting, the percentage of completion (POC) method is widely used to recognize revenue throughout the project’s duration. The construction execution stage is where the actual construction work takes place.

- When costs are incurred during the construction or development phase of a project, they are initially recorded as CIP on the balance sheet.

- An accountancy term, construction in progress (CIP) asset or capital work in progress entry records the cost of construction work, which is not yet completed (typically, applied to capital budget items).

- Best practice involves creating new subtasks and cost codes to track change order expenses separately from original budget items.

- Because office buildings, multifamily properties and warehouses may take several years to complete, this “temporary” classification may remain on a company’s books for several years.

When costs are incurred during the construction or development phase of a project, they are initially recorded as CIP on the balance sheet. These costs include direct expenses, such as materials, labor, and equipment, as well as indirect costs, such as permits, licenses, and supervision cip accounting fees. By capitalizing these costs, companies can accurately reflect the value of the project and its impact on the financial position. Construction companies and contractors understand construction projects can span months or years before completion due to the scope of work.

Units-to-Deliver Method

Join us on this journey as we navigate the intricacies of construction in progress accounting and learn key strategies for success in construction financial management. Some countries or tax jurisdictions may allow businesses to claim tax deductions or benefits related to the costs incurred during the construction or development phase. By capitalizing these costs, companies can more accurately calculate and support their tax deductions, ensuring compliance with applicable tax laws.

- Construction in progress accounting plays a crucial role in tracking and managing construction costs throughout the entire construction project lifecycle.

- Imagine a real estate development company embarking on a project to construct a commercial building.

- If your company is planning an expansion or large-scale construction job or just needs help with construction accounting, you need an experienced CFO team on your side to keep a detailed account of your finances.

- By leveraging construction accounting software and embracing technology, construction companies can optimize CIP tracking, improve financial management processes, and drive overall project success.

- CIP is used for long-term construction projects while WIP is for short-term production of inventory.

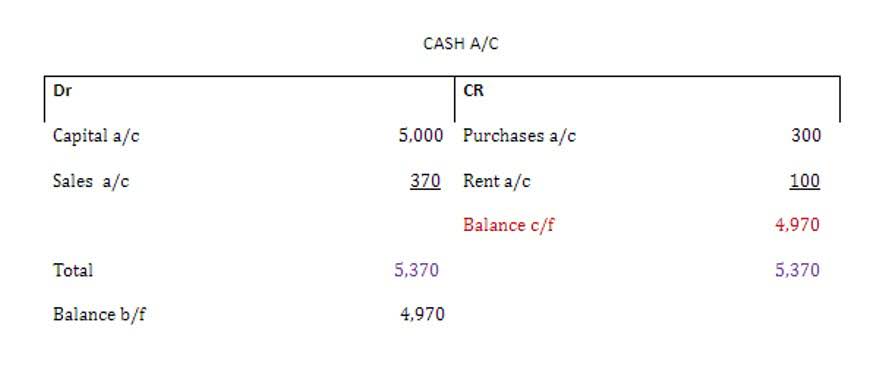

Additionally, it explores the process of transferring the costs from the construction in progress account to fixed asset accounts to ensure proper asset recognition and depreciation. Effective construction cost tracking is a crucial aspect of construction in progress (CIP) accounting, which is essential for accurate debit and credit management. By accurately monitoring and managing costs, construction companies can achieve better cost control, improve project management, and make informed financial decisions. Companies must record any real estate they own on their balance sheets as long-term liabilities. Real estate developers, home builders, and companies that hire contractors to build their business property, such as offices or warehouses, must also record any building in the process of construction on their balance sheets.