Paying by cheques can be costly, and mailing them out means they can take a long time to arrive and risk getting lost in the mail. Credit card payments can also be a hassle, leading to hefty processing fees, which some vendors may require you to pay. Telemedicine has revolutionized the way healthcare services are delivered, and bookkeeping hearing health is no… The balance sheet shows that the practice had total assets of \$46,000, total liabilities of \$25,000, and total equity of \$21,000 as of December 31, 2023.

- Like most business owners, you may wonder if you are doing your books correctly.

- Plus, many suppliers will offer you early payment discounts, which can reduce your expenses and help you better manage your cash flow.

- Outsourcing to a bookkeeping team can provide you with visibility on the cash flow of your overall practice.

- The freedom that a remote bookkeeper offers is one of the main advantages.

- Starting an AI implementation should be tackled in the same way as any major software implementation.

- This eliminates the hassle of writing and mailing cheques and ensures that you are never late paying an invoice again.

Performance and Reports

Lucro’s strategic planning services are crafted for clinic success, guiding you through financial roadmaps that align with your goals. We provide actionable insights and plans to help you scale effectively and sustainably. QuickBooks Online is one of the top accounting software currently available. This cloud-based accounting software safely stores all your crucial financial data in the cloud, meaning it can be accessed from anywhere on any device.

Success

Given the meticulous record-keeping demands of chiropractic practices, prioritize candidates exemplifying keen attention to detail and unwavering accuracy. With your foundations and reporting set, we’re ready to guide you toward boosting profits and enhancing performance through our one-on-one chiropractic business coaching service. We’ll provide guidance and actionable steps to keep you on track and foster business growth. Unfortunately, most practices are not collecting all the money they earned. Let’s face it, it’s brutal collecting from insurance companies and patients. This is where automation and hiring a tax professional comes in so you don’t leave money on the https://www.bookstime.com/ table.

Bookkeeping Services for Chiropractors

We want you to have a successful practice and not have to worry about accounting so you can focus on your trade while we focus on ours. Our solutions will keep your books current and your tax burden low. We offer all-inclusive accounting packages for every size practice. An outsourced bookkeeping firm also has knowledge of utilizing cloud-based accounting software and other cloud-based tools.

Revenue Growth

- In the digital age, technology plays a crucial role in streamlining bookkeeping processes for chiropractic businesses.

- Running a profitable clinic requires successful bookkeeping for chiropractors.

- We handle your books, so you can focus on aligning your patient’s health.

- These are not just technicalities that you can ignore or delegate to someone else.

- Not sure where to start or which accounting service fits your needs?

- However, these practices are not exhaustive or definitive, and they may vary depending on your specific circumstances and preferences.

Market conditions, supply chain disruptions, and seasonal variations can cause unexpected cost increases, making it difficult to stick to budgets. • Ensure robust data governance and security to deal with vast amounts of sensitive financial data. Our top-performing doctors consistently rely on Lucro to make critical decisions that drive their growth and help them scale.

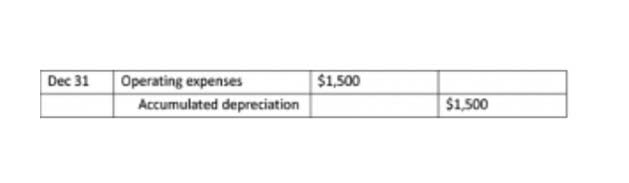

Each month, your bookkeeper sorts out your chiropractic business transactions and creates a financial report. If they require any additional information from bookkeeping for chiropractors you, they’ll make contact. Tax planning helps minimize tax liabilities, avoid penalties, and ensure compliance with ever-changing tax laws.

- Performing weekly checkups on your finances is a good way to make sure your cash flow is healthy, expenses are being paid, and money is being put back into the business.

- This facilitates an enlightened decision-making process before committing long-term.

- Currently, agentic AI that can act autonomously, make decisions and execute tasks without requiring constant human input remains in its early stages for specific applications such as accounting.

- This will give you insight into your profit margins and help you keep your staffing costs in check.

- For contractors managing several projects simultaneously, tracking costs and ensuring profitability for each one can be overwhelming.

- The owner can use this information to assess the profitability of the practice, and compare it with the previous periods or the industry benchmarks.

By staying current on your financial information, leveraging cloud-based technology, and enlisting the help of trained experts, you can ensure that your books are always accurate and current. Bookkeeping is an important task because it keeps you informed on the financial health of your practice and gives you the facts you need to make crucial business decisions. When your practice is small, combining your personal and business finances may seem tempting. This is a mistake that many business owners make, and it can complicate your bookkeeping process considerably. Another way to improve your accounting and taxation skills and knowledge is to enroll in a course or workshop that covers the topics relevant to your practice. You can learn from experts and peers, and gain practical and theoretical insights.