The principle states that expenses should be recognized in the period in which revenues are incurred. Including fixed overhead as a cost of the product ensures the fixed overhead is expensed (as part of cost of goods sold) when the sale is reported. The key difference from variable costing is that fixed production costs are included in the inventory valuation and expense recognition under absorption costing. Careful COGS calculation as per GAAP standards is essential for accurate financial reporting.

Cost of manufactured goods.

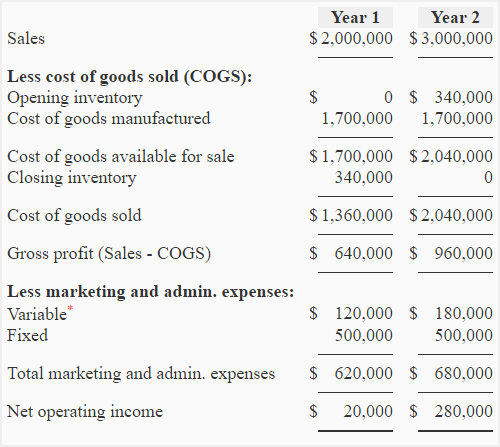

Variable costing techniques that help identify product contribution margins (as more fully described in the following paragraphs) are essential to guiding the decision process. Since inventory costs are not expensed until sold, the two income statements will give different operating income. In periods where production declines, the opposite effect happens – fixed costs are released from inventory, increasing cost of goods sold and lowering net income. The sales tax deduction calculator is also known as the traditional income statement.

Managerial Accounting

Decision making is not as simple as applying a single mathematical algorithm to a single set of accounting data. A good manager must consider business problems from multiple perspectives. In the context of measuring inventory and income, a manager will want to understand both absorption costing and variable costing techniques.

Example of calculating Selling expense and Example of administrative expense

Adjustments are made for the level of output differences if the actual output level is higher or lower than the normal output level. The amount of over-absorption is deducted from the total cost of items created and sold if the actual output level exceeds the typical output level. As a result, when using an absorption statement, it is common to find that the expense on the income statement is smaller. Variable cost Fixed MOH is a period cost and is treated as if it were ALL incurred regardless of the level of production. Net income is derived by subtracting all expenses (COGS and operating expenses) from total sales revenue. Below is a break down of subject weightings in the FMVA® financial analyst program.

5: Compare and Contrast Variable and Absorption Costing

By means of this technique to determine profits, no distinction is made between variable and fixed costs. As the absorption costing statement assumes that products have fixed costs, all manufacturing costs must be contained within the creation cost, whether variable or fixed. Additionally, it is not helpful for analysis designed to improve operational and financial efficiency or for comparing product lines.

- Once you have the unit cost, the rest of the statement if fairly straight forward.

- Mastering these mechanics can lead to GAAP-aligned and incremental accounting.

- Based on absorption costing methods, the additional unit appears to produce a loss of $0.50, and it appears that the correct decision is to not make the sale.

- According to accounting tools, the primary item on an absorption income statement is gross revenues for the period.

- Ethical business managers understand the benefits of using the appropriate costing systems and methods.

To allow for deficiencies in absorption costing data, strategic finance professionals will often generate supplemental data based on variable costing techniques. As its name suggests, only variable production costs are assigned to inventory and cost of goods sold. These costs generally consist of direct materials, direct labor, and variable manufacturing overhead. Fixed manufacturing costs are regarded as period expenses along with SG&A costs. The short answer is that the fixed manufacturing overhead is going to be incurred no matter how much is produced.

To get the gross margin, minus gross sales from the cost of goods sold. To compute net operating income for the period, subtract selling expenses. The traditional income statement, also known as the absorption costing income statement, is created using absorption costing. Costs are divided into product and period costs in this income statement. It’s also known as complete costing because it accounts for all direct manufacturing costs, including labor, raw materials, and any fixed or variable overheads.

Specifically, a portion of the contents of the beginning inventory cup would be transferred to expense commensurate with the decrease in inventory. Since the inventory cup contains less under variable costing, expect expenses to be lower and income to be higher. All fixed costs, including manufacturing overhead are reported on the income statement at the given amount. Generally accepted accounting principles only require absorption costing for external reporting, not internal reporting.